Payments App Development: A Complete Guide for 2022

Mobile app development

The first online transaction was supposedly conducted in 1994. Since then, the global payments market has grown to nearly $60 billion in 2021. Largely due to the adoption of mobile phones, online payment apps, and e-Commerce. As such many entrepreneurs are looking to create payment apps to tap into this burgeoning opportunity.

The most common methods of payments before payments apps were cards, cash, or cheques. While cash was convenient as transactions were real-time, carrying and storying cash is a hassle. Cheques take a while to complete the transaction while cards do provide access to bank accounts balance for both the sender and receiver, cards also need to be carried separately.

E-wallet apps development provides users the options to make payments in real-time without touch, cards, or exchanging cash notes. It is easy, safe & convenient. Users simply have to use their mobile phones and make the payments. The receiver will also receive the payment directly into their wallets or bank accounts and as such will not need to store the cash or cheques.

What Is Payment App Development?

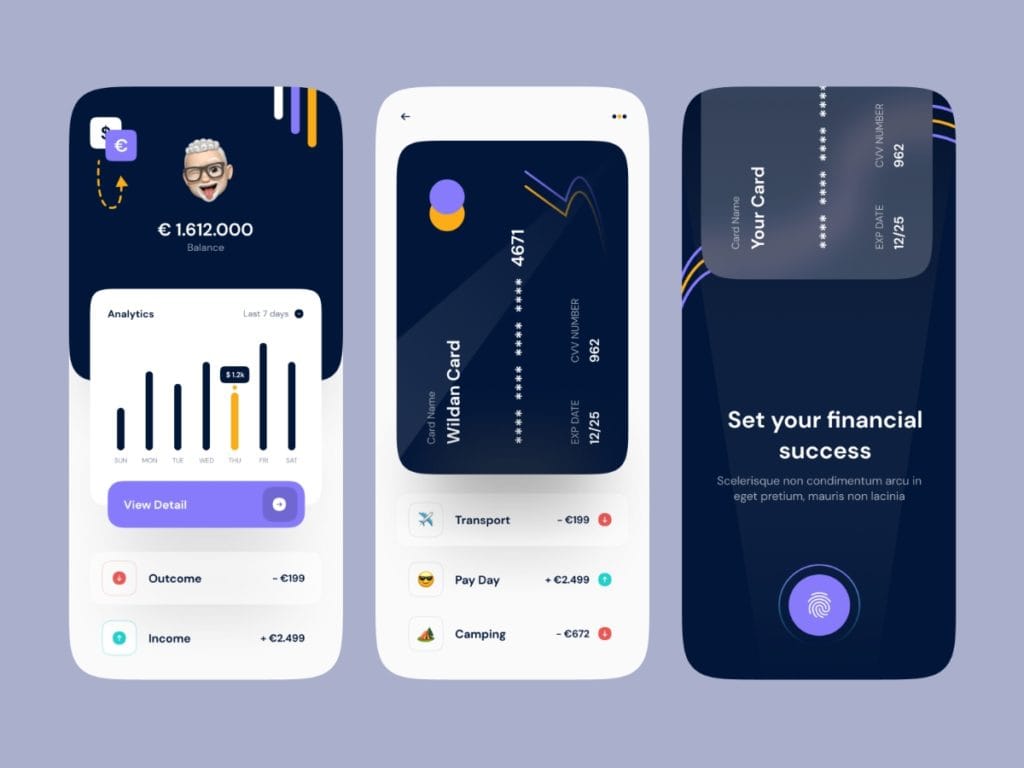

A payment app allows individuals and businesses to send and receive money through an app. The app uses digital technologies such as NFC, Bluetooth, QR codes, and payment interfaces to conduct transactions.

The app can be connected to an existing bank account and can also store & use credit and debit cards for sending money.

Expert mobile app developers will develop payment apps that can be used on any mobile phone with features such as QR payment, NFC enabled payment and mobile number linked transactions.

Payments apps will also provide e-wallets where users can store cash which can be used for real-world transactions. Offers, discounts and other incentives such as cashback and reward points will encourage the user to adopt online payment apps instead of using cash or cards.

Some Prominent Examples of Payment Apps

Google Pay

Google Pay allows users to conduct in-person or online transactions using the Google Pay app. Google Pay also offers services related to ticket booking, government services wherever applicable, and bill payments for electricity, utilities and also stores loyalty cards.

Google Pay heavily uses NFC, that is Near Field Communication by using the NFC chips in a phone and the NFC chip of a terminal that communicates with each other to complete the transaction.

Amazon Pay

Much like Google Pay, Amazon also lets users pay using its payment interface known as Amazon pay. The major advantage users get with Amazon pay is that they can use the wallet to purchase items from Amazon and users can connect the merchant account and Amazon seller account to collect payments.

As nearly 50% of the eCommerce transactions of the US market happens on Amazon, Amazon pay is an attractive option for many Amazon users.

Venmo

Venmo is the most popular payment app in the US. It allows the user to add and store their debit or credit card for payments. Everything is secured with high-grade encryption. Venmo right now is miles ahead of all the other apps on the market for payment apps in terms of popularity.

Major Features For Payment Apps Development

To make your app successful, here are the major features you need to include in your payment app.

Instant Login

Users can get registered quickly using email or phone. This will allow users to quickly get registered on the app and start using it.

Two Factor Authentication

The security of the app needs to be of the highest order as it will be used for financial transactions and hold sensitive financial information.

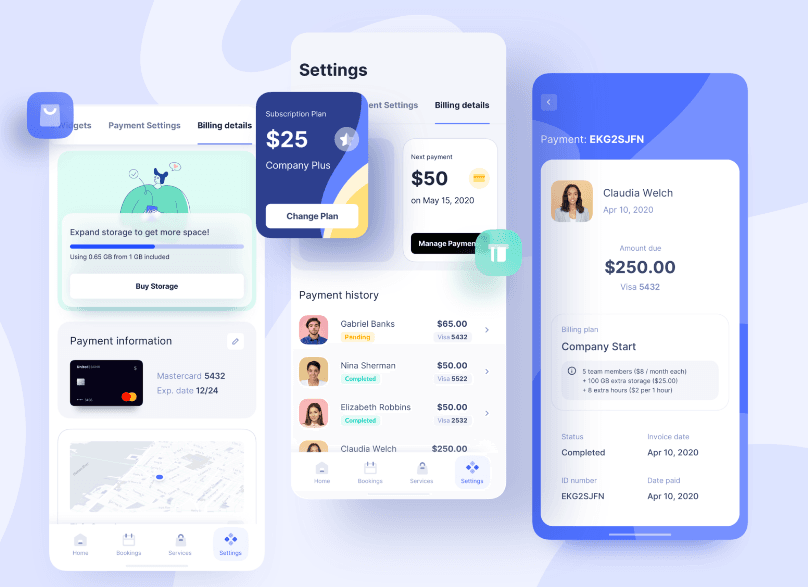

A sample Payment App interface

Integration of Bank Account/Bank Linking

The user will be able to integrate their authorized bank account with the digital wallet account instantly. Using a credit/debit card or net banking.

Wallet Topup/ Add Money

The user can add money to the wallet from the respective integrated bank or through gift vouchers and promotional offers/coupons. That amount of money will be reflected in the wallet after adding.

Send Money

The user will be able to transfer the money in various ways. This transfer amount activity will take some specific information about a receiver. The money could be transferred to the bank account or to another wallet as well as through QR codes, NFC, and mobile phones. Payment interfaces can also be used to facilitate the transaction.

Passbook Feature

This feature allows the user to check the wallet amount and the recent transaction history.

Split bill facility

Users can split bills with other users of the app. This feature can be used for travel & trips, meals, and common bill payments.

Auto Debits

For electricity, credit card bills, and other such regular payments, auto-debits can provide users the option to pay the bills as they arise.

Promotions & Cashbacks

Users can avail various cashback and promotional offers which will also entice them to adapt to the payments app over other methods of transaction.

Fund Transfer

Users can transfer funds to and from bank accounts, between other users and businesses for any kind of transaction.

Payment Receiving

Any user or business can receive payment through QR codes, mobile numbers,s or unique user IDs

POS Payments

With Point Of Sale payments, users can pay using the app with NFC or Bluetooth, or other such technologies and don’t have to swipe cards.

Loyalty Card Storage

Users can avail the offers and discounts of loyalty cards while they are purchasing from their respective shops & stores. Integrated loyalty cards will automatically add the offer and discount from the store.

Admin Side Features

User Side Management

Admin will be able to manage all users registered with the application along with the transactions and also be able to track the activities on the application. Also, the admin will be able to block and add any specific user.

Dashboard

The dashboard will show the admin a quick figure and characteristics about the overall progress to the application in the form of figures and charts.

Offers management

Admin can create offers, coupons and also will be able to track and manage them.

Reports

The admin will be able to get the business data in the form of reports.

Transaction Management

The admin will be able to track and manage all transactions accruing on the platform.

Block Users & Suspicious Payments

Any user engaging in shady behaviors or illegal transactions can be blocked by the admin side.

Things to Keep In Mind While Developing The App

Here are the key things to keep in mind while developing the app

Do Research

To decide on the basic functions, main features the market size and requirements and your app’s positioning as against competitors. While you may not have all the answers from the get-go do have at least a relatively clear idea of what you are going for.

Don’t Compromise on Security

While making the app, always opt for the highest security standards and comply with all laws and regulations. A high level of security will be a key selling point of your app and it will be a must to attract users.

Figure Out User Engagement

To ensure faster adaption of your app, focus on UI/UX and the promotional offerings to entice the users.

Figure out Positioning

Are you going to be B2C or B2B? Figure out your place in the market before you start so that features can be added accordingly.

Tech Stack

Here is a tech stack that we think should make for a good app. You can pick and choose other technologies as per your preference and requirements.

iOS – Swift/Obj C, Apple XCode/Intellij Appcode

Android – Java, Android Studio/Eclipse

Notifications – Chrome notifications, Rest APIs

Unique ID and OTP verification – Bamboo invoice, Rest APIs

Digital wallet – Rest APIs

Sending bills and invoices: Firebase, Twilio, Nexmo, Digimiles

Sending and receiving money – Dwolla, ACH

Biometric authentication – Optical fingerprint, Inbuilt sensors

Conclusion

Payment apps development is a burgeoning industry and holds a lot of potential for future growth. The right mix of features and functionalities can make your app a huge success. If you are looking to launch your own payments app and need any kind of help or just want to brainstorm, do drop us a line below. Our consultations are free & NDA backed.

Healthcare

Healthcare  Education

Education  Real Estate

Real Estate  Logistic

Logistic  Fitness

Fitness  Tourism

Tourism  Travel

Travel  Banking

Banking  Media

Media  E-commerce

E-commerce  Themes

Themes

Plugins

Plugins

Patterns

Patterns