How To Build A BNPL App Like Perpay: Complete Development Guide 2025

Keyur Patel

September 12, 2025

44 min

Here’s a fun fact: Nearly 40% of Buy Now Pay Later (BNPL) shoppers are highly likely to abandon a cart or purchase a less expensive product if the BNPL option is unavailable. It is not only for show-off products; it applies to everyday essentials.

But here’s the catch: Not all BNPL apps are created equal. Some have hidden fees. Others don’t help build your goodwill. And most are not designed for users with bad credit scores or limited financial history.

So, how do you retain potential customers who get frustrated using credit tools that penalize them for trying to get ahead?

Continue reading, as we have designed this blog to help you convert hot leads. We will discuss how you can build a BNPL app like Perpay, and even better than that. Over the years, Perpay has become a leading credit-building BNPL platform and a lifeline for underbanked consumers and shoppers with limited credit access.

We will cover everything from how Perpay works, what sets it apart, and who it serves, to how to replicate (and enhance) its features, architecture, monetization model, and legal safeguards.

You will also discover which technologies to use, how to price the development, which features are a must-have, and how to scale your app securely and responsibly.

Let’s get started!

Introduction To The BNPL Landscape

Buy Now Pay Later, or BNPL, is more than just a trendy acronym. It’s a financial revolution changing how millions of people shop, budget, and manage debt. From groceries and gas to gadgets and home furniture, consumers are choosing installment-based payment models over traditional credit cards or loans.

BNPL adoption has surged in the past three years, especially among millennials, Gen Z, and credit-challenged users. What once started as a convenience for online shopping is now a go-to financial tool for everyday essentials and emergency needs.

With flexible payment plans, instant approvals, and zero-interest options, BNPL apps have made deferred payments more accessible than ever.

But here’s something fascinating: Apps like Perpay are not just enabling purchases. They are helping people build credit, access necessary goods, and strengthen their financial standing without resorting to high-interest credit cards or payday loans. It is where the real disruption lies.

➡️By combining spending power with financial upliftment, apps like Perpay are rewriting the credit narrative.

In 2025, building a BNPL app is not just a business opportunity. It’s a chance to serve millions of underserved consumers who are looking for fairness, flexibility, and financial empowerment.

What Is Perpay And Why Does It Matter In 2025

Perpay is more than just another Buy Now Pay Later app. In this section, you will explore the fundamentals of its landscape.

What Is Perpay?

Perpay is a Buy Now Pay Later app that allows users to purchase products without upfront costs and pay over time through small, scheduled installments.

Unlike most BNPL platforms, Perpay also reports payments to credit bureaus, which helps users build or rebuild their credit score responsibly. It functions as a shopping app and a credit-building tool, making it a unique player in the financial technology space.

Who Is Perpay Designed For?

Perpay targets users who often struggle with access to traditional credit. Its platform is highly beneficial for:

- Shoppers with sub-par credit or no credit history

- Underbanked individuals without access to credit cards or loans

- Gig workers, freelancers, or hourly earners with unpredictable income

- Budget-conscious consumers who prefer structured payment plans

All this makes Perpay more inclusive and mission-driven than many other BNPL providers.

How Perpay Works

Perpay works by having users link their income source, typically through direct deposit. Based on this data, the platform sets personalized spending limits. Users can shop from a marketplace of thousands of products and pay over time through automatic deductions.

This structure protects users from overspending and promotes better financial habits. Simultaneously, it gives the company a clear comprehension of the user’s payment capacity, reducing lending risk.

Why Perpay Matters In 2025

As credit inequality continues to broaden, apps that offer responsible and inclusive financing are becoming more relevant. In 2025, the financial industry is increasingly favoring tools that not only let users delay payments but also empower them to build a better financial future.

Perpay stands out because:

- It combines credit-building with structured repayments, helping users boost their credit scores while making essential purchases.

- There are no hidden fees or surprise charges, addressing the demand for ethical and transparent fintech solutions.

- It encourages financial discipline by connecting directly to users’ income sources (typically via direct deposit) and setting personalized spending limits.

- It focuses on affordability and transparency, making it especially appealing to underbanked users and those with poor or no credit history.

Perpay’s growing success reflects a significant shift in user expectations: people now want more than just flexible payments. They’re looking for fintech platforms that prioritize trust, credit growth, and real financial empowerment.

For entrepreneurs and developers, Perpay serves as a blueprint for how BNPL apps can evolve into meaningful, long-term credit solutions.

Perpay vs. Other BNPL Giants: Klarna, Afterpay, Affirm, Sezzle, And More

The Buy Now Pay Later ecosystem is growing rapidly. However, not every platform is built to serve the same type of customer. While Perpay is ideal for people with low credit scores or no access to traditional financing, other BNPL apps shine in different areas, such as fast approvals, broad merchant integrations, or international usability.

Hence, we have created the following side-by-side comparison for excellent clarity.

| Criteria | Perpay | Affirm | Afterpay | Klarna | Sezzle | Zip (Quadpay) | Splitit | PayPal Pay in 4 |

| Credit Check | No hard check, soft income link | May conduct soft or hard credit checks | No credit check | Performs soft checks | Soft credit check | Soft check only | No credit check | Soft credit check |

| Credit Building | Yes, reports to major bureaus | Yes, selectively reports | No reporting | No reporting | Yes, reports to bureaus | No credit reporting | No reporting, uses existing credit | No credit reporting |

| Target Audience | Users with bad credit, underbanked | Prime borrowers, some fair credit | General audience | Younger shoppers, flexible spenders | Credit rebuilders | Young shoppers seeking quick BNPL | Credit card holders looking to split payments | PayPal users seeking flexible short-term financing |

| Interest / Fees | No interest, fixed spending limit | Interest on longer-term plans | No interest | Interest on longer plans | No interest, fees on rescheduling | No interest, fees on installment | No interest, no fees | No interest or fees if on time |

| Approval Speed | Manual review plus income validation | Fast, soft check first | Instant approval | Fast approval | Instant decision | Instant approval | Instantly approved based on available card credit | Instant for existing PayPal users |

| Repayment Schedule | Auto payroll deduction | Monthly payments, flexible terms | 4 bi-weekly payments | 4, 6, 12-month plans | 4 split payments | 4 split payments | Matches your credit card’s billing cycle | 4 equal payments every 2 weeks |

| Spending Limit | Custom limit based on income | Higher limits with a credit check | Lower default limits | Ranges from small to higher purchases | Starts low, increases with trust | Starts low, increases with repayment | Based on your existing card credit limit | Up to $1,500 to $2,000 |

| Integration with Merchants | Direct purchases from a curated marketplace | Thousands of partners + direct checkout | Global retail support | Millions of retailers worldwide | 44,000+ merchants | 45,000+ merchants | Available anywhere Visa/MC is accepted | PayPal merchants and retailers |

| Geographic Reach | USA only | US, Canada, UK, Australia | US, UK, Australia, NZ | Global | US and Canada | US, Australia, NZ | Global | US and select global regions |

| Unique Selling Point | Helps build credit via payroll-linked installment plans | Transparent terms, credit building, and longer terms | Simple UI, no interest | Flexible long-term BNPL, app experience | Focus on responsible spending | Fee-based model with a large retail base | No new debt, leverages credit already granted | Trusted PayPal network, instant access |

Market Positioning And User Perception

When it comes to brand perception, Klarna and Afterpay lead in the fashion and lifestyle sectors. Affirm is often associated with electronics and large-ticket purchases. PayPal Pay in 4 is highly preferred by loyal PayPal users who seek familiarity.

Perpay, however, holds a unique space. It is perceived as a financial tool for people rebuilding trust in the credit system. Its loyal customer base sees it not only as a BNPL app but as a stepping stone toward financial independence.

Verdict

While platforms like Klarna, Affirm, Afterpay, and others offer strong retail integrations and swift checkouts, Perpay’s strength lies in its mission to help underserved consumers build financial momentum. It is not just about deferring payments; it is about restoring financial dignity and faith.

➡️If your target audience includes users with low credit scores, income volatility, or a need for financial literacy, then building a Perpay-style BNPL app may offer deeper, long-term value than just another checkout option.

Top 25 Best Apps Like Perpay And Their Key Features [2025]

Not all Buy Now Pay Later apps are built the same. Some are better suited for users with strong credit scores, while others support those looking to rebuild. Whether you’re shopping for furniture, electronics, or everyday essentials, there’s a growing list of apps like Perpay personalized to different needs.

Below is a curated list of the 25 best Perpay alternatives in 2025, highlighting each app’s core strengths and ideal use cases.

Comparison Table: Best Perpay Alternative Apps 2025

| App Name | Key Features | Best For |

| Affirm | Transparent payment terms, no late fees, credit check required | Big-ticket items, responsible users |

| Afterpay | No interest, four equal installments, no credit check | Fashion, beauty, and impulse shopping |

| Klarna | Pay in 4, monthly plans, browser extension, soft credit pull | Versatile shoppers, tech-savvy users |

| Sezzle | Reschedules allowed, reports to TransUnion, interest-free | Credit building, flexible budgeting |

| Zip (Quadpay) | Pay in 4, works online and in-store, mobile-friendly app | Mobile-first users, in-store shopping |

| Splitit | No applications or credit checks, uses existing credit card limit | Users with credit cards, zero-hassle payments |

| PayPal Pay in 4 | Zero interest, works with existing PayPal account, trusted platform | Everyday shoppers, PayPal users |

| Zebit | No credit check, shop directly through the platform, fixed terms | Bad credit, direct marketplace shopping |

| ViaBill | Pay in four, recurring billing for subscriptions | Subscription services, repeat customers |

| Perlstreet | Equipment financing, longer terms, B2B focus | Businesses, freelancers, startups |

| Sunbit | Designed for healthcare, auto, and dental financing | Medical expenses, service-based payments |

| Bread Pay | Monthly payments, credit-based financing | Big purchases, furniture and electronics |

| Credova | Outdoor and sporting goods focus, lease-to-own options | Niche retail categories, adventure gear |

| LazyPay | Instant approval, credit line for online purchases (India-specific) | Fast access in emerging markets |

| Tala | Microlending, credit building in developing economies | Global users, mobile-first countries |

| Cashew Payments | Embedded BNPL for the MENA region, seamless checkout | UAE, Saudi Arabia, GCC users |

| Hokodo | B2B BNPL, invoicing solutions for SMEs | Europe-based vendors and wholesalers |

| Cheese | Credit-building card with installment options for immigrants and students | Underbanked, newcomers, students |

| Zilch | Tap to pay, cashback rewards, interest-free | Millennials, cashback lovers |

| Empower | Cash advances, budgeting tools, and credit-building | Financial empowerment, US-based users |

| Possible Finance | Alternative payday loans, credit reporting, and mobile-only | Credit rebuilding, emergency needs |

| OneBlinc | No credit check, designed for federal employees | Stable-income users, government workers |

| FlexShopper | Lease-to-own electronics and furniture | Bad credit, large items with flexible terms |

| Katapult | Non-prime consumers, the lease-to-own model | Non-traditional credit buyers |

| Acima | Lease solutions for durable goods | No-credit or thin-file applicants |

Categorizing The Alternatives: Find What Fits You Best

Payment Apps Like Perpay For Online Shopping

- Klarna, Afterpay, Zip, PayPal Pay in 4

Installment Apps Like Perpay For Bad Credit

- Zebit, Katapult, Acima, FlexShopper, OneBlinc

Apps Like Perpay That Build Credit

- Sezzle, Possible Finance, Empower, Tala

No Interest Apps Like Perpay

- Klarna (Pay in 4), Afterpay, Zilch, PayPal Pay in 4

Apps Like Perpay With Higher Limits or Rewards

- Affirm, Bread Pay, Zilch, Cashew Payments

Perpay Alternatives For Niche Use Cases

- Sunbit (dental and auto), Credova (outdoor gear), Perlstreet (equipment)

Quick Recap: There is no single best Perpay alternative. The most suitable app depends on what matters most to your users, irrespective of whether it’s no-interest financing, bad credit support, cashback rewards, or broader merchant access.

Understanding these differences will help you identify gaps in the market and build a more refined BNPL app that caters to underserved niches and underbanked users.

Why Build A BNPL App Like Perpay In 2025?

The BNPL landscape is evolving rapidly, offering a golden opportunity for developers, fintech entrepreneurs, and digital retailers. As consumers shift away from traditional credit cards, flexible payment apps are reshaping how people buy, borrow, and foster financial stability.

Perpay represents the next wave of BNPL solutions that do more than defer payments. It instills trust, enables credit growth, and increases purchasing power for underserved users.

Below are compelling reasons for developing a BNPL App like Perpay in 2025.

Rising BNPL Adoption And Growth Potential

According to market forecasts, the global BNPL industry is expected to reach approximately USD 687 billion in transaction value by 2028 from nearly USD 334 billion in 2024.

In 2025, the sector is witnessing steady double-digit growth as retailers seek to boost average order value and reduce cart abandonment. With platforms like Perpay introducing credit-building features, the potential extends beyond retail.

- Millennials and Gen Z are driving adoption. These generations prefer transparent payment tools over revolving credit.

- Merchants are embracing BNPL to increase checkout conversion, repeat purchases, and customer loyalty.

- Financial institutions and neobanks are exploring BNPL integrations to attract users and cross-sell credit products.

Demographics That Need Responsible BNPL Options

Perpay’s success highlights a significant shift. The focus is no longer just on instant gratification, but also on financial empowerment.

- Underbanked consumers often lack access to credit cards or traditional loans.

- Users with thin credit files or poor credit scores are underserved by conventional lenders.

- Gig workers and freelancers seek flexible payment models that match income volatility.

These groups are actively searching for safe, low-risk alternatives to payday loans or maxed-out cards. Apps like Perpay deliver affordability, structure, and credibility.

Regional Adoption And Global Expansion

While BNPL began in markets like the US, UK, and Australia, it is now expanding to Asia, the Middle East, and Latin America.

- In the United States, regulatory interest is rising, but demand remains rock-solid among low-credit shoppers.

- The UK and EU are emphasizing responsible lending practices, giving ethical BNPL apps an edge.

- GCC countries (like UAE and Saudi Arabia) are witnessing a fintech boom with Sharia-compliant BNPL variants gaining ground.

- In India and Southeast Asia, BNPL is bridging gaps in financial inclusion and retail access.

This opens doors for regionalized Perpay-like platforms that adhere to the local compliance rules and user behavior.

Business Advantages Of A Credit-Building BNPL App

A Perpay-style BNPL product delivers value to all stakeholders, and vital ones are:

- Increased customer retention through credit-building and long-term loyalty programs.

- Higher average order values and lower return rates when users are financially committed.

- Rich data insights for merchants and partners based on repayment behavior and purchase trends.

- Reputation lift for offering financial products that promote growth rather than debt traps.

➡️If you build responsibly, users will not just use your app; they will advocate for it.

What This Means For You: 2025 is the perfect time to create a BNPL app that combines affordability, credit growth, and regional relevance. Users want more than delayed payments. They want financial tools that genuinely improve their future.

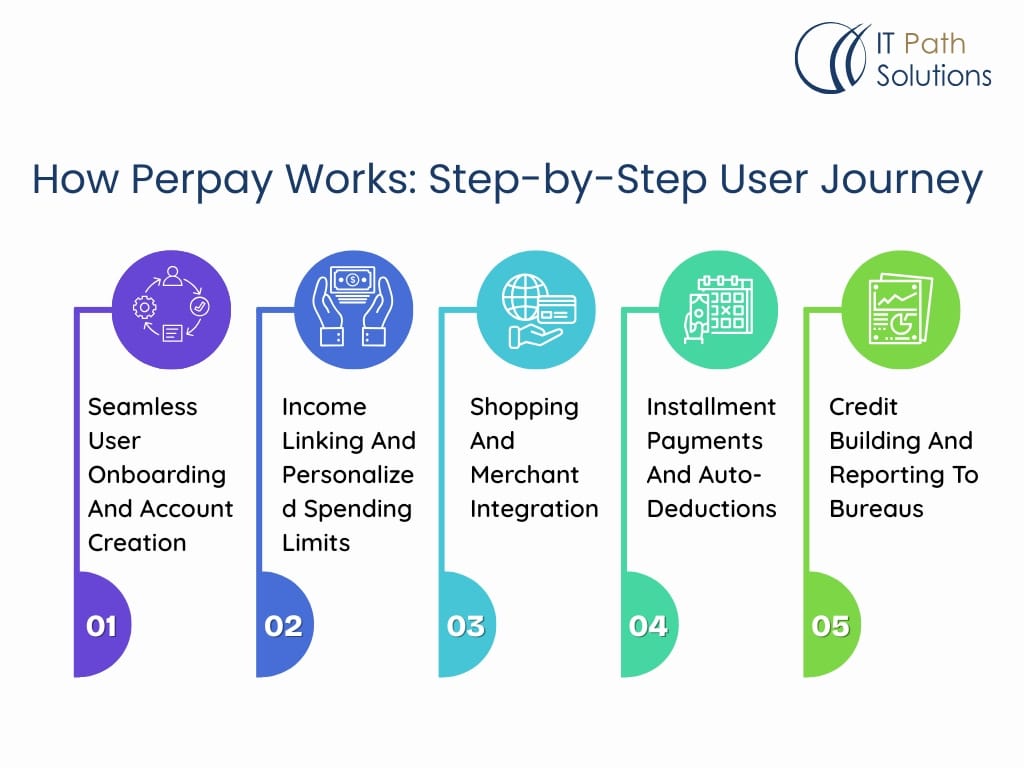

How Perpay Works: Step-by-Step User Journey

You need to walk through the actual user journey to understand Perpay’s effectiveness. From onboarding to credit reporting, every touchpoint is intentionally designed to lower risk, boost confidence, and help users make shrewder financial decisions.

Below is a detailed look at how Perpay functions in real time.

Step 1: Seamless User Onboarding And Account Creation

- First, users are guided through a simplified sign-up process that removes friction. Rather than relying on traditional credit checks, Perpay allows users to register with fundamental information such as name, phone number, email, and employment details.

- Next, the app verifies identity using Know Your Customer (KYC) protocols to ensure the user is genuine. At this stage, users are also required to connect their income source, usually a direct deposit account.

➡️Why It Matters: It enables Perpay to personalize the user’s limit based on actual income patterns, not just a static credit score.

Step 2: Income Linking And Personalized Spending Limits

After onboarding, users securely link their payroll or bank account. Perpay reviews these income streams to assign spending limits that reflect their repayment capacity.

Most importantly, this system protects both parties. Users aren’t offered more than they can afford, while Perpay reduces potential defaults.

- Personalized spending limits reduce the risk of over-borrowing

- Income-based approval fosters fairness for users with thin credit profiles

This process also ensures that the platform remains inclusive without sacrificing financial responsibility.

Step 3: Shopping And Merchant Integration

Once approved, users can start shopping through the Perpay marketplace. It offers an extensive range of products, including electronics, furniture, appliances, fashion, and essentials.

The app does not allow external purchases, which helps manage risk and ensures merchants are aligned with Perpay’s payment structure.

Moreover, prices are transparent, and there are no added fees, interest, or late penalties.

- Merchants receive complete payment upfront

- Users repay in small, scheduled installments

- All orders include definite timelines and payment expectations

This model builds trust while boosting merchant relationships.

Step 4: Installment Payments And Auto-Deductions

Repayment begins with the purchases. Perpay automatically deducts payments from the user’s linked income source in small chunks, aligned with their payday cycle.

- Weekly or bi-weekly payment schedules match cash flow

- Users avoid manual payments, reducing the risk of missed deadlines

- This consistent repayment structure supports credit stability

Because everything is automated and predictable, users experience less stress and greater confidence.

Step 5: Credit Building And Reporting To Bureaus

Perhaps Perpay’s most substantial value lies in its ability to help users build credit. After a successful repayment history, users become eligible for Perpay Plus, which reports payments to prominent credit bureaus, such as Experian, Equifax, and TransUnion.

- Credit reporting turns every purchase into a stepping stone for sound financial health.

- Positive activity helps users access better rates, cards, or loans over time.

It sets Perpay apart from most BNPL apps, which do not impact credit scores.

Through this final step, Perpay transforms from a payment app into a financial growth platform.

Smart Summary: Perpay simplifies credit access by aligning spending with income, automating payments, and enabling credit growth. Its structured journey benefits both users and merchants while setting a high standard for responsible BNPL apps.

Perpay’s Business Model And Revenue Streams

While many BNPL platforms compete on speed and convenience, Perpay sets itself apart with a sustainable and consumer-friendly business model. Its core strength lies in monetizing responsibly, without relying on hidden fees or interest.

Let’s explore how Perpay earns revenue while maintaining user trust.

Merchant Fees As A Primary Revenue Stream

One of the most consistent income sources for Perpay comes from merchant partnerships. Brands and retailers pay Perpay a service fee for listing their products on the platform and offering interest-free installment options to users.

This model benefits both sides. Merchants receive total payment upfront, and Perpay assumes the repayment risk. In return, Perpay earns a predictable margin from each transaction.

- Merchants gain higher conversion rates and average order values

- Perpay secures revenue without charging the end-user

- Customers enjoy a no-interest experience with transparent pricing

This dynamic ensures mutual value and loyalty across the ecosystem.

Credit-Building As A Monetizable Add-On

Perpay provides salient services to everyone, but users who enroll in Perpay Plus earn access to credit reporting features. It is positioned as a premium feature and opens up new monetization paths.

- Perpay charges a small fee for credit reporting and related services

- These fees support partnerships with credit bureaus and compliance frameworks

- As user credit scores improve, retention and lifetime value also increase

This approach turns a socially valuable feature into a long-term profit center.

Marketplace Margin On Product Sales

Perpay sells products directly through its curated online marketplace. By sourcing goods in bulk or partnering with brands, it secures wholesale pricing.

The difference between wholesale and retail value generates a margin on every sale. Unlike traditional e-commerce platforms, Perpay benefits from a closed ecosystem that minimizes refund rates and boosts order consistency.

- Branded product sales offer scalable revenue

- Product mix is aligned with essential and repeat purchases

- Inventory management is streamlined through partner fulfillment

It keeps logistics lean while maintaining a quality user experience.

Subscription-Based Models

Perpay is gradually exploring subscription offerings beyond Perpay Plus. These may include access to exclusive deals, speedier shipping, or additional financial tools like budget coaching or bill reminders.

Although not yet a primary stream, this line of monetization has strong potential in 2025. Reason: Consumers grow more comfortable paying for premium financial experiences.

Data Insights And Affiliate Revenue

With a growing user base and a wealth of transaction data, Perpay can generate additional income through:

- Anonymous analytics shared with retail partners

- Trend reports for consumer product demand

- Referrals to external financial products (credit cards, insurance, etc.)

Perpay ensures all data-sharing is privacy-compliant and anonymized, focusing only on aggregated behavioral patterns.

The Bottom Line: Perpay thrives on a balanced revenue model driven by merchant fees, product margins, and premium credit features. This approach creates user trust while unlocking long-term profitability without relying on interest or penalties.

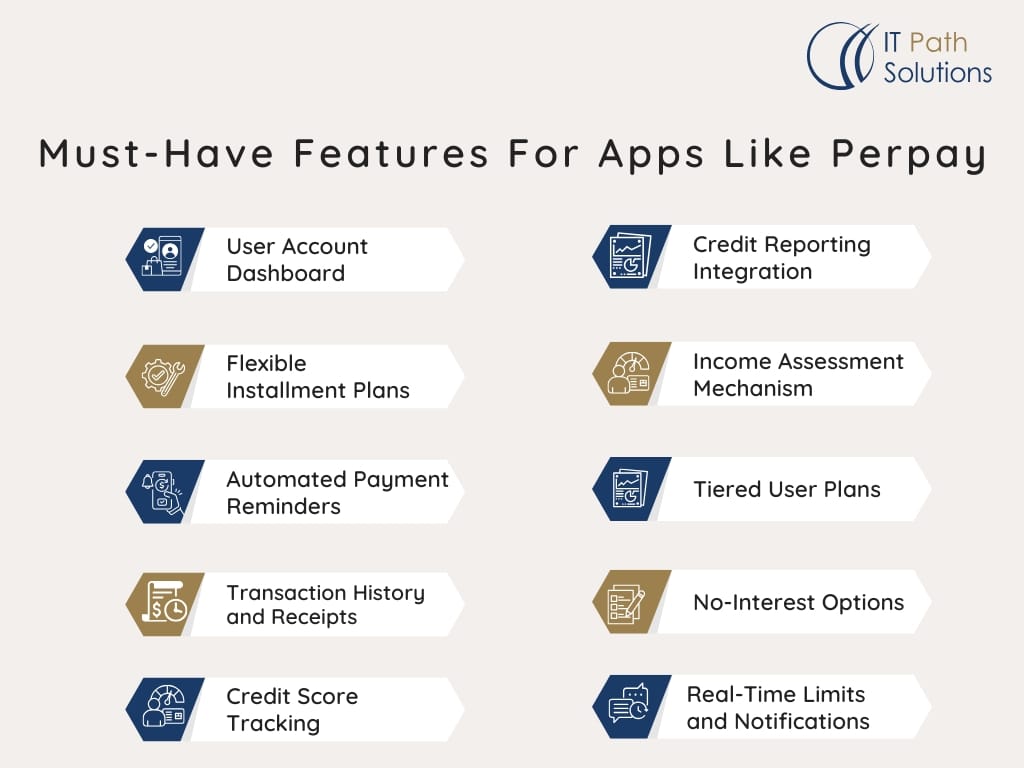

Must-Have Features For Apps Like Perpay

Once you understand how Perpay generates revenue, the next logical step is identifying the pivotal features that power its success. Building a competitive BNPL app in 2025 requires more than just splitting payments. You need to create a system that promotes responsible spending, builds trust, and encourages repeat usage.

Below is a breakdown of the necessary features every Perpay-like app must include, along with innovative add-ons that can distinguish your product.

Core MVP Features For BNPL Functionality

Commence with the foundational components that users expect from any BNPL app. These features form the baseline for usability and trust.

User Account Dashboard

A centralized view where users can track purchases, payment schedules, credit-building status, and available spending limits.

Flexible Installment Plans

Options for bi-weekly, monthly, or income-linked payments personalized to user preferences.

Automated Payment Reminders

Timely notifications to prevent missed payments and amplify repayment rates.

Transaction History and Receipts

Transparent records that help users manage their spending and monitor their financial behavior.

Credit-Building And Financial Empowerment Tools

In 2025, users no longer seek just convenience. They want features that elevate their financial outlook. Incorporating credit-enhancing tools is crucial for adoption and retention.

Credit Reporting Integration

The ability to report on-time payments to credit bureaus like Experian, Equifax, and TransUnion.

Credit Score Tracking

Real-time access to users’ credit scores and suggestions to augment them.

Income Assessment Mechanism

Links to payroll systems or bank accounts to assess earning patterns and provide spending limits accordingly.

No-Interest And Transparent Pricing Tiers

Today’s digital consumers are cautious of hidden fees and unclear pricing. Offering definite, structured tiers builds confidence.

Tiered User Plans

Allow users to unlock more spending power or features with consistent repayments or optional upgrades.

No-Interest Options

Provide a detailed explanation of how you make money, reinforcing that there are no surprise fees.

Real-Time Limits and Notifications

Alert users when they are nearing their spending threshold or have payments due, keeping the experience stress-free.

Advanced Personalization And User Retention

Present-day BNPL apps need to be intelligent. Use AI to personalize the experience, predict behavior, and boost engagement.

AI-Based Insights and Suggestions

Recommend budget-friendly purchases, repayment schedules, and credit-building actions based on user behavior.

Referral Rewards and Social Features

Let users invite friends for cash or credit incentives while promoting app stickiness.

Custom Payment Limits and Goals

Allow users to set their own goals or limits, encouraging responsible use and deeper engagement.

Seamless Support And User Experience

Support is not just about fixing problems. It’s a brand-building opportunity. A smooth support system keeps users loyal.

In-App Chat Support

24/7 automated or human-backed assistance for account issues, payment problems, or product queries.

Educational Modules

Bite-sized tips on credit, budgeting, and safe borrowing practices that guide first-time users.

One-Tap Repeat Purchase

Allow returning users to repurchase or reorder past items with minimal effort, making the experience frictionless.

What You Should Know: A successful BNPL app must balance convenience with financial responsibility. By offering credit-building, transparency, savvy automation, and engaging support, your app can attract users and earn long-term loyalty.

Technical Architecture to Build BNPL Apps Like Perpay

After outlining essential features, the next step is understanding the technical foundation required to build a future-ready and secure BNPL app like Perpay.

In 2025, users demand real-time performance, seamless integrations, and complete data privacy. Therefore, your architecture should not only support scale but also prioritize trust and compliance.

This section will walk you through the key components of a modern BNPL app’s architecture, starting from the frontend interface to backend logic and cloud deployment.

Frontend Framework And UI Layer

Your frontend is your user’s initial impression. It should be responsive, lightweight, and easy to navigate across mobile and desktop.

- Recommended Technologies: React Native or Flutter for cross-platform mobile app development.

- UI Considerations: Incorporate intuitive design systems with a clear payment dashboard, progress trackers, and accessible typography.

- Performance Optimization: Use lazy loading, responsive rendering, and local caching to reduce latency and load times.

Backend Infrastructure And Microservices

The backend is where the BNPL magic happens. This layer handles user authentication, credit logic, transaction history, and installment processing.

- Recommended Stack: Node.js with Express or Django with Python for scalable APIs.

- Microservices Design: Separate services for authentication, payments, user profiles, and analytics.

- Database Choices: PostgreSQL or MongoDB for structured and semi-structured data, with Redis for caching high-demand queries.

Credit Scoring And Income Verification Engines

These engines determine personalized spending limits and repayment eligibility.

- APIs to Integrate: Plaid, Argyle, or Yodlee for income verification and transaction insights.

- Scoring Logic: Implement AI-powered scoring models using user behavior, spending consistency, and employment history.

- Storage and Computation: Use isolated containers to securely process sensitive data and compute repayment models in real time.

Payment Gateway And Merchant Integration

BNPL platforms require a payment system that can split, schedule, and settle payments across multiple entities.

- Gateway Options: Stripe, PayPal, Adyen, or Braintree for handling split payments.

- Merchant Integration: APIs for syncing order data, product details, refunds, and transactional feedback from retail partners.

- Ledger System: Maintain a double-entry ledger to ensure payment accuracy and transparency across buyers and merchants.

Hosting, Deployment, And Scalability

Digital-era BNPL apps often scale fast, especially during seasonal shopping peaks. Your cloud infrastructure must be ready for spikes in usage.

- Preferred Platforms: AWS, Google Cloud, or Azure with Kubernetes for container orchestration.

- Scaling Features: Auto-scaling groups, load balancers, and real-time monitoring dashboards.

- Monitoring Tools: Use Prometheus, Grafana, and Sentry to catch issues beforehand and optimize user experience.

Real-Time Systems And Event-Driven Architecture

Real-time systems are crucial to deliver immediate feedback on payments, approvals, and account activity.

- Event Bus Technologies: Kafka or RabbitMQ for message brokering between services.

- WebSockets or Push Notifications: Power real-time alerts about upcoming payments, account activity, or transaction statuses.

- Data Sync: Ensure smooth synchronization across mobile and web apps to reflect up-to-date balances and limits.

Localization And International Readiness

If you plan to expand your BNPL app globally, design with internationalization in mind.

- Currency Handling: Use libraries like Money.js or Dinero.js to support multi-currency logic.

- Language Support: Create content files to easily expand the app in different regions and languages.

- Regulatory Hooks: Add flexibility to plug in compliance rules based on the user’s region.

Core Insight: A powerful BNPL app must be more than functional. With modular services, secure payments, and real-time decision engines, your tech stack should empower growth while safeguarding your users and data at every step.

Security, Compliance, And Credit Bureau Integration

Now that we have covered the architecture, it is time to focus on the protective shield that makes BNPL apps trustworthy. Security, compliance, and proper credit integration are not just backend tasks. They are core pillars of any successful and growth-friendly BNPL solution.

Users share their income data, payment details, and identity information. Therefore, your platform must inspire absolute confidence from day one.

Let us explore the crucial security protocols, compliance frameworks, and integrations with illustrious credit bureaus.

Data Security And User Protection

Users will only trust your app if they feel their personal and financial data is safe. Robust encryption and infrastructure-level defenses are paramount.

- Encryption: Use AES-256 encryption for sensitive data, including PII and banking details. Ensure data is encrypted in transit using SSL/TLS.

- Tokenization: Replace sensitive payment data with non-sensitive equivalents to minimize exposure during processing.

- Access Control: Implement strict role-based access control for backend services and admin dashboards. Avoid overexposure to internal teams.

PCI DSS And GDPR Compliance

Security is not optional. Regulatory bodies expect BNPL platforms to comply with financial-grade standards.

- PCI DSS: Required for storing or processing cardholder data. Choose PCI-compliant gateways like Stripe or Adyen to reduce direct handling.

- GDPR: If operating in the EU or with EU citizens, ensure comprehensive compliance with data usage, deletion rights, and consent mechanisms.

- CCPA and Other Regional Laws: Prepare templates and user consent flows that can be adapted to local data privacy laws.

KYC And AML Checks

Onboarding customers without verifying their identity or source of income can create significant legal risks. Adherence to KYC and AML standards builds a trustworthy environment.

- KYC Verification: Integrate identity verification platforms such as Onfido, Jumio, or Veriff for photo ID and facial matching.

- Income and Employment Verification: Use tools like Argyle or Truv to confirm employment status and earnings directly from payroll providers.

- AML Screening: Monitor for red-flag behaviors and run checks against international watchlists and financial risk databases.

Secure Payment Flows And Fraud Prevention

BNPL platforms face the risk of synthetic identity fraud and payment abuse. You need to prevent fraud without hindering user experience.

- Multi-factor Authentication (MFA): Add an extra layer of account protection during login or high-value actions.

- Device Fingerprinting: Analyze devices, browsers, and behavioral patterns to detect suspicious sessions.

- Fraud Analytics: Build rules that detect anomalies such as unusual spending patterns or mismatched geographic activity.

Credit Bureau Reporting And Integration

Perpay is successful partly because it helps users foster credit. You should integrate credit reporting early in your product lifecycle.

- Major Credit Bureaus: Partner with Equifax, Experian, and TransUnion to report timely payments.

- Custom Credit Models: Develop your own risk models using transaction history and employment patterns, especially for underbanked users.

- Opt-in Reporting: Give users control by letting them opt in to credit reporting as a feature. It boosts transparency and confidence.

Regional Lending Licenses And Consumer Protection

Different markets have different rules. If your BNPL app expands globally, customize your legal playbook based on local requirements.

- US Requirements: Conform to the Truth in Lending Act (TILA) and state-specific lending licenses.

- EU Requirements: Follow the EU Consumer Credit Directive, with unambiguous disclosure rules for interest rates and payment terms.

- GCC and SEA Markets: Understand Shariah-compliant finance (in GCC) or e-wallet licensing (in Southeast Asia) for smoother onboarding.

Main Point: Security and compliance are not secondary layers. They are foundational to building a BNPL app that earns trust, scales without legal friction, and serves both businesses and users responsibly.

Cost To Build A BNPL App Like Perpay

After covering security and compliance, let us now move to one of the most asked questions: how much does it actually cost to build a BNPL app like Perpay? Whether you’re a founder, product manager, or investor, understanding the budget scope helps you plan resources, timelines, and feature sets more effectively.

Though the final price depends on your business goals and geography, this section breaks down pivotal cost factors to help you make informed decisions.

Cost Breakdown By Feature Complexity

The more complex the feature set, the higher the pricing. Here is a rough (approximate) estimate based on the core and advanced functionalities needed to replicate or enhance Perpay.

| Feature Set | Estimated Cost Range (USD) |

| User onboarding and KYC | $5,000 to $10,000 |

| Income verification and credit checks | $7,000 to $12,000 |

| Product catalog and shopping flow | $8,000 to $15,000 |

| Payment gateway integration | $6,000 to $10,000 |

| Installment plan scheduler | $5,000 to $8,000 |

| Credit bureau reporting module | $6,000 to $10,000 |

| Admin dashboard and user analytics | $7,000 to $12,000 |

| AI-based credit scoring or insights | $10,000 to $20,000 |

| Security, encryption, and fraud detection | $8,000 to $15,000 |

| Compliance and legal features | $5,000 to $10,000 |

Note: These are ballpark estimates for building an MVP with scalable architecture.

Development Team Structure And Cost Influence

You can build your app with different team models, each impacting cost, speed, and control.

| Team Type | Pros | Cons | Hourly Rates (USD) |

| In-house team | Full control, consistent communication | Higher cost, slower hiring | $80 to $150 |

| Offshore agency | Cost-effective, quick ramp-up | Time zone gaps, variable quality | $30 to $60 |

| Hybrid model | Balance between quality and cost | Requires coordination | $50 to $90 |

IT Path Solutions follows a hybrid model that ensures affordability without compromising quality or security standards.

MVP vs. Full-featured Product Cost

Determining between a minimum viable product (MVP) and a fully loaded version can save time and money in the early stages.

| Scope | Timeline (Weeks) | Estimated Cost (USD) |

| MVP | 10 to 14 | $45,000 to $65,000 |

| Full-featured app | 16 to 24 | $80,000 to $150,000 |

Hidden And Recurring Costs To Account For

Beyond development, there are ongoing costs for operations, support, and scalability.

- Cloud hosting and infrastructure (AWS, GCP, Azure): $500 to $2,000 per month

- Third-party APIs (KYC, credit bureaus, payment gateways): $0.10 to $1 per API call

- Security audits and compliance updates: $2,000 to $5,000 annually

- Maintenance and support: Typically 15 to 20 percent of development cost annually

Tips To Optimize Cost Without Compromising Quality

- Build an MVP with only the must-have features, then iterate based on user feedback

- Use open-source libraries and pre-built integrations when security permits

- Choose an experienced offshore partner with fintech domain knowledge

- Avoid building credit bureau integrations from scratch; use trusted aggregators

What You Should Know: Building a Perpay-like BNPL app can range from $45,000 for an MVP to $150,000 for a complete solution. Thoughtful prioritization and the ideal team setup can significantly optimize costs.

Step-by-Step BNPL App Development Process

Once you understand the costs, the next logical step is to plan your development journey. Building a Buy Now Pay Later app like Perpay is not just about coding; it involves thorough research, strict compliance, and customer-centric design.

Let us walk through the full-cycle process of creating a BNPL product, from idea to post-launch scaling.

Step 1: Discovery And Market Research

Before a single line of code is written, begin by understanding your target audience and business goals.

- Identify user pain points and gaps in current BNPL offerings

- Analyze top apps like Perpay, Affirm, Klarna, and Afterpay

- Determine your niche: bad credit users, students, specific product categories

- Finalize the product scope and monetization strategy

This phase shapes the app’s unique value proposition and positions it against competitors.

Step 2: Legal Readiness And Compliance Blueprint

Next, consult legal experts specializing in financial technology and lending laws.

- Check if your region requires a lending license

- Prepare your AML (Anti-Money Laundering) and KYC policies

- Align with PCI DSS and data protection laws such as GDPR or CCPA

- Determine whether your app will report to credit bureaus

Compliance planning at this stage prevents expensive changes down the line.

Step 3: UI/UX Design And Wireframing

After legal groundwork, move to experience design. Your goal is to make the app lightweight, transparent, and trusted.

- Build low-fidelity wireframes and user flow charts

- Focus on ease of onboarding and frictionless navigation

- Include key screens: sign-up, product catalog, payment plans, profile, and dashboard

- Conduct usability testing to polish interaction design

Use tools like Figma or Adobe XD for collaborative design reviews.

Step 4: Backend And Frontend Development

Once the wireframes are approved, developers start building the product in phases.

➡️Frontend stack options:

- React Native or Flutter for cross-platform mobile development

- React.js or Vue.js for the web interface (if applicable)

➡️Backend stack options:

- Node.js, Django, or Ruby on Rails for scalable microservices

- PostgreSQL or MongoDB for secure data storage

➡️This phase also includes third-party integrations:

- Payment gateways (Stripe, PayPal, Adyen)

- Identity verification and income APIs (Plaid, Argyle)

- Credit bureau integrations (Experian, TransUnion, Equifax)

Development happens in sprints, with each module undergoing quality assurance and testing.

Step 5: Testing And Pre-Launch Compliance Checks

Before going live, ensure your app is secure, bug-free, and compliant with regulatory standards.

- Perform penetration testing, performance testing, and load balancing

- Validate your data encryption, secure login, and storage mechanisms

- Ensure complete adherence to privacy and lending laws

- Conduct test transactions to validate installment logic and reporting flows

Include both internal and external beta testers for real-world feedback.

Step 6: Beta Launch And Iteration

Roll out your MVP to a select user group and collect detailed feedback.

- Analyze drop-off points and usage heatmaps

- Test vital features like payment plans, user limits, and reporting flows

- Use feedback to fine-tune the product, especially onboarding and repayment journeys

At this stage, focus on speed, responsiveness, and clarity.

Step 7: Full Launch And Post-Launch Growth Strategy

Once the app is stable and validated, it is time to go public.

- Launch with a robust customer support system

- Set up user education flows and onboarding tips

- Start targeted marketing campaigns and influencer partnerships

- Track retention, AOV, repayment rates, and credit-building impact

Over time, add engaging features such as referral systems, personalized credit offers, and reward loops.

The Crux: A successful BNPL app launch requires far more than development. Legal discovery, compliance, user research, and feedback loops are just as crucial as design and coding.

BNPL App Monetization: Strategies Beyond Merchant Fees

Once your BNPL app, like Perpay, is live and gaining traction, the next priority is unlocking diverse and sustainable revenue streams. Though traditional Buy Now Pay Later platforms earn through merchant commissions, today’s most successful apps are diversifying to maximize profitability and user lifetime value.

Let us explore how you can go beyond the basics and build a monetization engine that not only fuels revenue but also transcends user experience.

Subscription Plans And Premium Tiers

As your app matures, offer tiered services with added benefits.

- Launch a premium plan that provides higher spending limits, quicker approvals, and zero late fees.

- Introduce subscription-based access to financial coaching or credit-building analytics.

- Offer early repayment rewards or priority support to premium members.

This model can create a steady stream of recurring revenue and strengthen brand loyalty.

Financial Insights And Credit Education Tools

Today’s users appreciate transparency and education. You can monetize tools that help users track and reinforce their financial standing.

- Create a financial health dashboard with insights on spending habits

- Partner with credit counselors to offer personalized recommendations

- Provide downloadable credit reports or budgeting plans as a paid feature

These tools align with Perpay’s mission of helping users enrich their credit profiles over time.

Affiliate Partnerships And Marketplace Commissions

If your BNPL app includes a product catalog, partner with retailers or third-party platforms to monetize through referrals and upsells.

- Earn affiliate commissions when users buy from recommended stores

- Integrate featured brands or seasonal offers within the shopping flow

- Collaborate with platforms offering student loans, insurance, or repair financing

This revenue stream helps subsidize interest-free financing while expanding your app’s utility.

Add-On Services: Insurance, Warranties, And Protections

Offer micro-insurance options or product protection plans at checkout.

- Device protection for electronics

- Extended warranty plans for furniture or appliances

- Job loss protection for repayment delays

These add-ons can be positioned as optional upgrades and monetized on a per-transaction basis.

Rewards, Referrals, And Brand Partnerships

Gamify your app with user incentives to make it more gripping and shareable.

- Launch a points-based rewards system tied to on-time payments

- Offer referral bonuses for bringing in new users or merchants

- Collaborate with lifestyle brands to offer exclusive discounts or cashback

This model not only supports retention but also fuels organic growth through peer sharing.

Data Monetization (With Consent)

With complete user consent and legal safeguards, anonymized data can become a strategic revenue stream.

- Aggregate and license insights to merchants about user buying behavior

- Offer business analytics dashboards to retail partners

- Provide demand forecasting based on transaction patterns

Use ethical practices and unambiguous user opt-ins to cultivate trust and regulatory compliance.

Knowledge Drop: Your BNPL app can grow well beyond merchant fees by layering subscription services, educational tools, partnerships, and incentives. These strategies fuel user trust while generating long-term value.

Challenges In Building Perpay-Like Apps And How to Solve Them

Building a BNPL app that replicates the trust, scalability, and impact of Perpay is no small task. Though the opportunity is enormous, it comes with a unique set of challenges across credit risk, security, regulation, and user experience.

However, each obstacle can be turned into a growth enabler with strategic planning and the right tech stack.

Let us examine the key challenges you are likely to face and how to overcome them effectively.

Credit Risk Assessment In A Thin-File Market

Many users drawn to Perpay have limited or no credit history, making traditional credit scoring ineffective.

➡️Solution:

- Use alternative data sources like income deposits, rent payments, utility bills, and employment history.

- Integrate AI and machine learning models to predict repayment behavior more precisely.

- Collaborate with fintech-focused credit bureaus that support non-traditional metrics.

It enhances approval accuracy while minimizing default rates.

Fraud Detection And Prevention

Fraudsters often target BNPL apps due to their instant credit nature and digital onboarding.

➡️Solution:

- Implement device fingerprinting, behavioral analysis, and biometric verification during onboarding

- Monitor transaction patterns in real time using machine learning

- Use multi-factor authentication and CAPTCHA for added account security

These methods help reduce identity theft and synthetic fraud.

Legal And Compliance Complexity

BNPL services operate at the intersection of lending and consumer finance. It brings several layers of regulation.

➡️Solution:

- Perform legal discovery early in development to identify required licenses according to the region.

- Implement robust KYC (Know Your Customer) and AML (Anti-Money Laundering) checks.

- Ensure transparency through clear disclosures, especially for repayment terms and fees.

Working with legal advisors specializing in fintech can lower the risk of future compliance gaps.

Building Trust with Underbanked or Low-Credit Users

Users with poor credit histories may feel skeptical of digital finance tools.

➡️Solution:

- Offer definite pricing with no hidden fees or surprise charges

- Highlight credit-building benefits and show real success stories

- Provide proactive support channels such as live chat, email, and in-app guides

Empathy, transparency, and education foster lasting relationships.

Crafting A User Experience For Financial Simplicity

The target audience often includes individuals who are new to credit products or previously underserved.

➡️Solution:

- Prioritize intuitive design with simplified flows, visual dashboards, and automated reminders

- Reduce friction with income-based personalization and pre-approved limits

- Provide financial literacy content to help users understand how to use the app responsibly

Striking design is not only about aesthetics. It is about usability and confidence.

Scaling Infrastructure Without Compromising Performance

BNPL apps require growth-friendly backend systems that can process large volumes of concurrent transactions.

➡️Solution:

- Use microservices architecture to manage loads across payments, credit scoring, and user profiles

- Leverage cloud infrastructure with auto-scaling (AWS, Google Cloud, or Azure)

- Use caching and content delivery networks to ensure global performance

These measures support growth without tradeoffs in speed or uptime.

Must-Know Insight: Every challenge in BNPL app development can be turned into a competitive edge by leveraging the right technology, compliance, and user-first design. It helps ensure your app is not only secure but also trusted and future-proof.

Use Cases For Apps Like Perpay

As Buy Now Pay Later (BNPL) solutions continue to gain popularity, their applications go far beyond fashion or tech gadgets. Today, Perpay-like platforms are helping users access essential goods and services without relying on traditional credit or upfront payments.

These versatile use cases demonstrate why more entrepreneurs and investors are looking to enter the BNPL space.

Electronics And Gadgets

Smartphones, laptops, smart TVs, and gaming consoles often come with high upfront costs that deter many users. BNPL platforms allow customers to break these expenses into smaller, manageable payments while staying within their budgets.

- Example: A student buying a laptop for remote classes or a freelancer upgrading their home office setup.

Furniture And Home Essentials

From mattresses and desks to couches and dining sets, household furnishings can exhaust a monthly budget. Apps like Perpay make it more manageable for people to furnish homes without depleting savings or using high-interest credit cards.

- Example: A young couple moving into their first apartment who prefer structured payments over lump sum spending.

Fashion And Beauty

BNPL solutions also cater to fashion-conscious consumers looking to purchase apparel, skincare, or wellness products. Flexible payments encourage higher cart values and brand loyalty.

- Example: A fashion brand integrating a BNPL option to boost seasonal collection sales.

Car Repairs And Auto Services

Unexpected vehicle expenses can be financially draining. BNPL apps help consumers spread out payments for tires, repairs, and servicing.

- Example: A gig economy worker needing urgent car repairs to continue working without waiting for payday.

Medical And Dental Payments

Healthcare expenses are often unplanned and expensive. BNPL platforms offer an alternative to insurance gaps or upfront medical fees.

- Example: A patient using BNPL to cover a dental procedure or out-of-network consultation.

Students And Education Purchases

Many students lack credit history or stable income. BNPL options allow them to access academic tools like software, tablets, or certification courses on a payment schedule.

- Example: A college student using a BNPL app to pay for an online course or buy a refurbished tablet.

Home Improvement And Appliances

Large appliances like refrigerators, washers, or even minor renovations can be made more accessible through structured payment options.

- Example: A family replacing a broken washing machine without disrupting their monthly budget.

Gig Workers And Freelancers

Independent professionals often experience income volatility. BNPL gives them the flexibility to purchase the tools and equipment required to keep working.

- Example: A freelance photographer using BNPL to finance a new camera lens and repay as projects come in.

In a Nutshell: BNPL apps have evolved beyond retail, serving practical needs across education, healthcare, transportation, and daily living. This versatility makes them pivotal tools for financially conscious users in 2025.

How To Choose The Right Development Partner For Your BNPL App Like Perpay

By now, it is clear that building a BNPL app like Perpay requires more than just technical skills. You need a development partner who understands fintech nuances, compliance frameworks, and user psychology.

Selecting the wrong partner can result in delays, overspending, or even legal risks. The ideal one can turn your vision into a reliable, future-proof product.

Let us break down how to find the most suitable development team that aligns with your business goals.

Key Questions To Ask Before You Commit

Before you finalize a vendor, ask targeted questions that go beyond technical expertise.

- Have you built fintech or BNPL apps before? Can you show live demos?

- What is your approach to PCI compliance and KYC integration?

- How do you handle secure payment flows and data privacy?

- Can you help with credit bureau integrations or income verification APIs?

- Do you provide UX and product strategy guidance?

- What is your support structure after the app is launched?

These questions filter out generic developers and highlight teams with domain-specific expertise.

Red Flags To Watch Out For

Even a polished pitch can mask red flags. Here are some things to stay alert to:

- Vague pricing models or cost estimates without detailed scoping.

- Limited understanding of fintech regulations like AML or GDPR.

- No experience in building secure payment gateways or microservice architecture.

- Promising unrealistic timelines without milestone-based planning.

- Avoiding post-launch support discussions or maintenance planning.

Spotting these beforehand can save time and money later in the project.

Checklist For Evaluating A BNPL App Development Team

To simplify your vendor evaluation, use this checklist:

✅Proven experience in fintech or payment gateway integration

✅Proficiency with compliance protocols and credit scoring logic

✅A straightforward process for MVP to full-scale rollout

✅Ability to design for mobile-first, secure user experiences

✅Competency in scalable backend architectures

✅Fair pricing, with contingency for future updates

This checklist ensures that both strategy and execution are aligned.

➡️Expert Tip: For most BNPL startups or businesses testing this model, outsourcing to a domain-focused agency offers quicker returns and lower risk.

Final Thought: Selecting the ideal development partner is crucial for building a BNPL app that is secure, growth-friendly, and compliant. Look for fintech experience, transparent pricing, and a roadmap-first approach.

Conclusion

As consumer behavior shifts toward more inclusive and flexible financial solutions, the opportunity to build a responsible BNPL app like Perpay has never been more promising. Whether your goal is to serve underbanked communities, drive merchant conversions, or create a future-proof credit-building tool, the path is all set.

This guide has walked you through the essential comparisons, must-have features, technical foundations, monetization channels, and development process. Now, it is time to turn that knowledge into action.

Remember, this is not just a blog that you have read. It is your blueprint for launching a high-performance BNPL platform that is credit-friendly, regulation-ready, and built for long-term success.

You can confidently tap into this booming market with a product that is not just competitive but also compliant, growth-friendly, and personalized to your users’ needs.

If you’re serious about building a BNPL platform that is both profitable and ethical, IT Path Solutions can help you make it happen. Our team brings sound fintech experience, robust compliance knowledge, and future-ready development skills.

Book a free consultation to get your custom BNPL app roadmap designed by our fintech experts. Let us help you bring your idea to life, responsibly and rapidly.

Take the first step towards your fintech future today. Build something that is genuinely yours and inspire millions.

FAQ

What Are The Best Apps Like Perpay For Bad Credit?

Some of the best apps for users with low or no credit scores include Kikoff, Sezzle Up, and Brigit. These apps offer flexible repayment plans and credit-building features without requiring an excellent credit history.

Can I Use Multiple BNPL Apps At Once?

Yes, you can use more than one BNPL app, but it is pivotal to manage repayments carefully. Using multiple apps can affect your credit usage and spending habits if not handled responsibly.

Which Perpay Alternative Has The Highest Limits?

Apps like Affirm, Klarna, and PayPal Pay in 4 often offer higher spending limits based on user profiles. Creditworthiness, purchase history, and repayment consistency affect your eligible limit.

What Is The Best BNPL App In 2025?

The best BNPL app depends on your needs. For credit-building, Perpay and Kikoff are ideal. For international availability, Klarna leads. Affirm and Zip are reliable for instant approval and widespread use.

Do BNPL Apps Charge Hidden Fees?

Most reputable BNPL apps disclose their terms clearly. However, late fees, processing charges, or subscription models may apply in some cases. Always review the fee structure before committing.

How Fast Is Approval For Apps Like Perpay?

Approval is usually quick. Many apps offer instant or same-day approval, depending on the verification method. Connecting a bank account or income source can speed up the process.

Do All Apps Like Perpay Help Build Credit?

Not all BNPL apps report to credit bureaus. Perpay, Sezzle Up, and Kikoff are designed for credit building, while others focus only on flexible payment options.

Are BNPL Apps Better Than Credit Cards?

BNPL apps can be practical for short-term, interest-free purchases and users with limited credit access. However, credit cards often offer broader rewards and long-term credit-building opportunities.

Is It Safe To Connect My Bank Account To BNPL Apps Like Perpay?

Most BNPL platforms use encrypted APIs and banking-grade security to safeguard user data. However, always ensure the app is regulated, has stringent privacy policies, and uses secure data providers like Plaid or MX.

Do BNPL Apps Affect My Credit Score If I Miss Payments?

Yes. Though some BNPL apps do not report to credit bureaus, those that do (like Perpay, Affirm, or Sezzle Up) may report late payments, which can negatively impact your credit score. Always confirm before using.

Can I Use BNPL Apps For Services And Not Just Physical Goods?

Yes, some BNPL apps now support payments for services such as dental care, medical procedures, car repairs, and education. Availability depends on the app and the merchant’s partnership.

Do I Need A Job To Get Approved For A BNPL App?

Not always. While proof of income is often required, some platforms consider alternative data. It can be gig income, bank transactions, or government assistance when evaluating eligibility.

Can BNPL Apps Replace Traditional Credit Cards Entirely?

BNPL apps offer short-term flexibility but lack the universal acceptance, revolving credit lines, and long-term credit-building capabilities of traditional credit cards. For many users, BNPL is a helpful complement, not a replacement.

Keyur Patel

Co-Founder

Keyur Patel is the director at IT Path Solutions, where he helps businesses develop scalable applications. With his extensive experience and visionary approach, he leads the team to create futuristic solutions. Keyur Patel has exceptional leadership skills and technical expertise in Node.js, .Net, React.js, AI/ML, and PHP frameworks. His dedication to driving digital transformation makes him an invaluable asset to the company.

Related Blog Posts

Essential Features every Scalable Mobile App must have in 2026

Let’s start with a situation most product leaders recognize. It is early 2026. Your mobile app has finally found traction. Daily active users are climbing. Marketing campaigns are working. Investors are optimistic. Then something breaks. Screens take too long to load. This happens during peak hours. A payment fails silently. A security audit flags basic… Essential Features every Scalable Mobile App must have in 2026

How to choose the right Mobile App Development Partner for your Business Growth

Let’s start with a story that haunts the IT industry. A well-funded logistics company decided they needed a custom mobile app to track their fleet. They did what most companies do: they Googled mobile app development company, sent out a generic Request for Proposal (RFP) to the top five results, and picked the one with… How to choose the right Mobile App Development Partner for your Business Growth

November 1st Is NOT The Real Deadline For Android 15. Here’s What You’re Missing

Imagine waking up one morning and discovering your Android app is invisible to millions of users on the Google Play Store. No installs, no updates, no revenue. Sounds terrifying, right? It is not a science fiction plot; it is the looming reality many businesses and developers could face in November 2025 if they neglect the… November 1st Is NOT The Real Deadline For Android 15. Here’s What You’re Missing