Banks are progressively sending innovation escalated answers for developing their incomes, improving client experience, advancing cost structure and overseeing the change with the support of technologies.

With web and versatile banking, banks are currently concentrating on upgrading administrations like contract loaning, giving customer credits, and essential administrations like an investment account, term stores.

Banking administrations which are viewed as the retail incorporate an arrangement of reserve funds and exchange accounts, contracts, individual advances, check cards, and charge cards.

Retail banking is additionally recognized from venture banking or business banking and is one of the most important industries that need the support of technology.

Perform fundamental financial operations, for example, checking your bank balance, making a fixed deposit as per the need, including recipient and so on with our simple to use and understand interface.

Get a diagram of your use with our Intelligent spend noticing mechanism, which naturally labels and classifies your exchanges. You can use your net banking to enlist and sign in to use the comfort that our application brings to your life.

Be it purchasing your food supplies, the most recent hardware, booking your flight/train tickets or your next get-away trip, we have got it all covered for you.

The application delights you with cash investment and saving direction, notices, and hacks that are genuinely keen. It has the goal that you never need to rely upon a credit extension, but instead become independent.

These are basic cash sparing plans with a ‘reason’ to assist you with beginning your investment funds journey in no time flat. Each arrangement is attached to a prevalent brand and certifications included advantages.

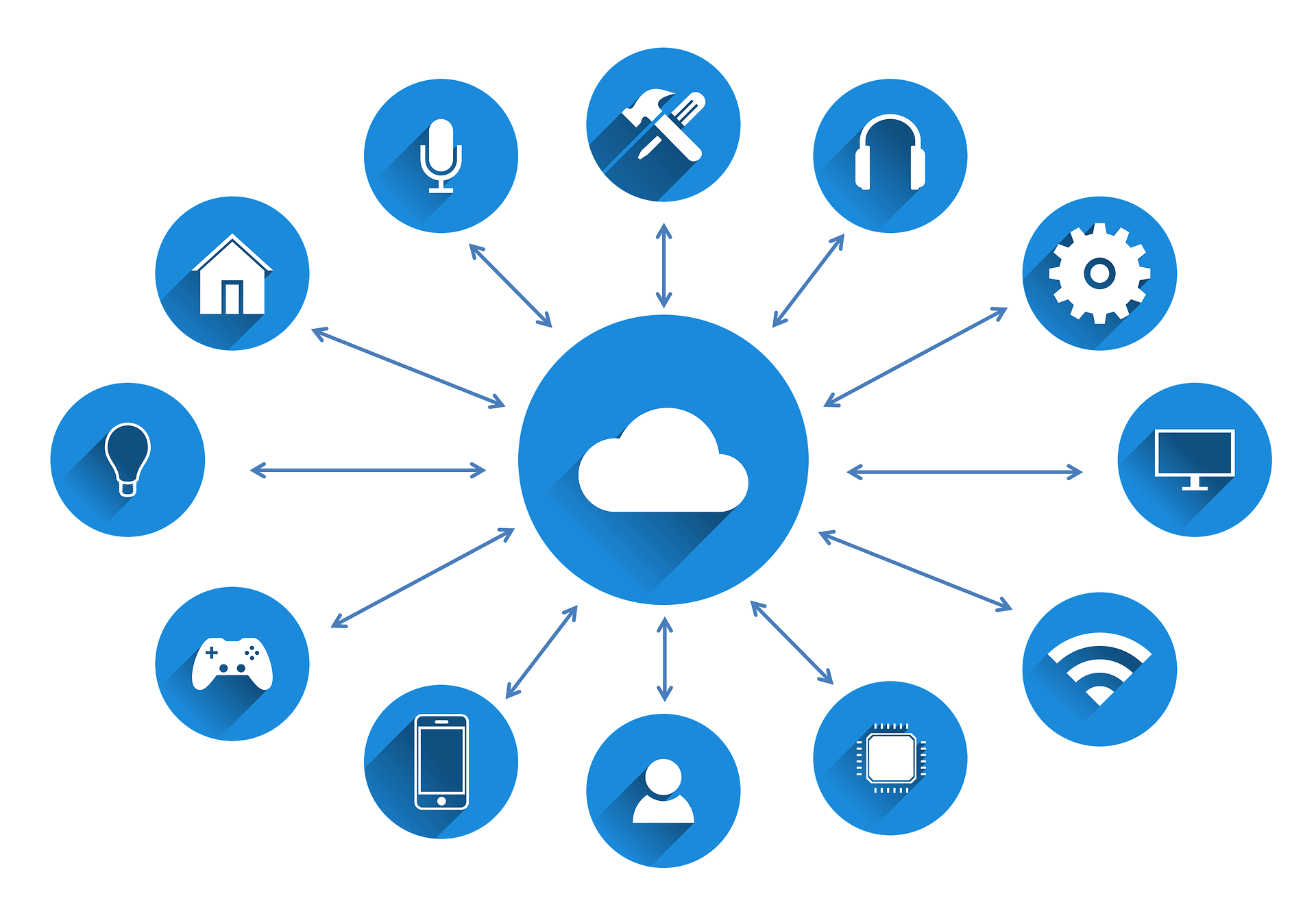

Voice-activated applications and such related gadgets have recently accomplished distinction with the arrival of new technologies. Voice-recognition aides have numerous conceivable use cases that include voice while banking on the internet.

Banks will know about the setting of the channel and can give fitting contextualized administration or guidance enhancing the connection experience.

Various businesses, incorporating those in the Finance and Banking business, are attempting to include the high-tech software and hardware into their administrations as well. While there is still some time before AR and VR genuinely grab hold in numerous enterprises, including banking, they have just begun to have an effect and cause effects.

We are aware how wearable gadgets will support money related and banking administrations and be more reliable to clients. Wearable innovation or wearable gadgets allude to PCs or electronic gadgets inserted into things/extras worn (wearables).

Chat bots are created to encourage two-way correspondence, supplanting channels, for example, telephone, email or content. The goal is to give speedy assistance and value-based help. Most essential errands, for example, balance request, financial balance subtleties, credit inquiries and so forth.